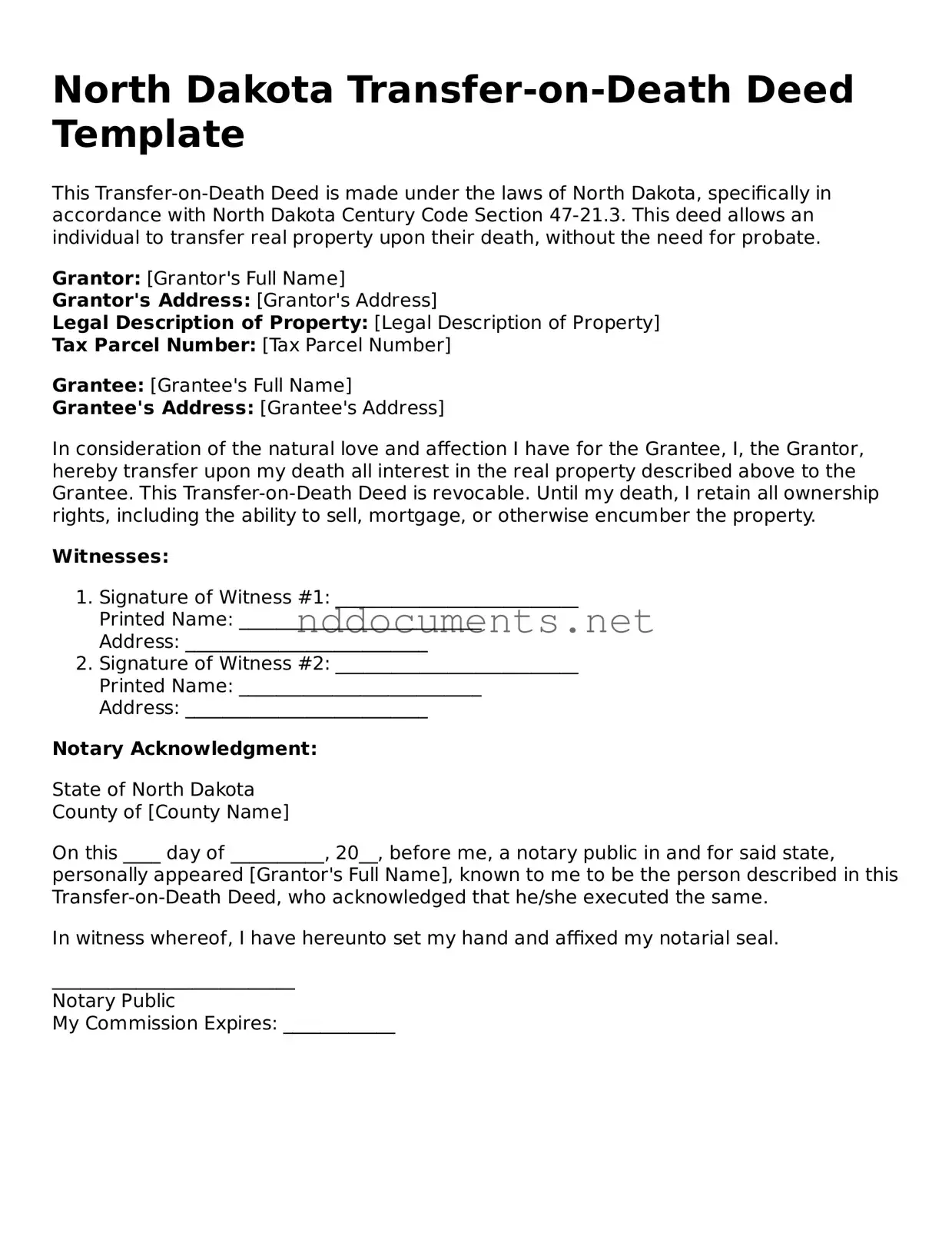

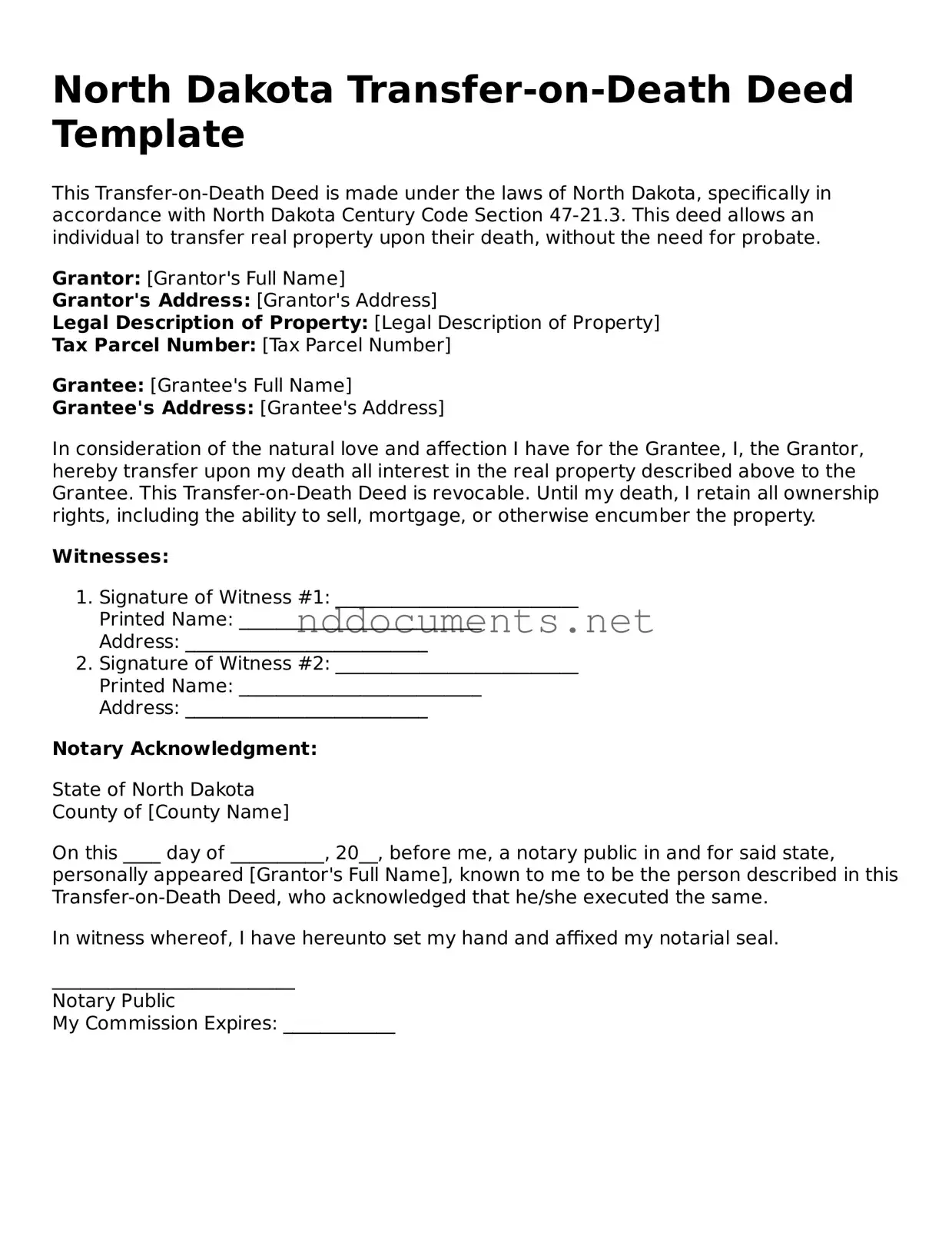

Fillable Transfer-on-Death Deed Document for North Dakota

A Transfer-on-Death Deed form in North Dakota allows property owners to designate beneficiaries who will receive their property automatically upon their death, without the need for probate. This legal tool simplifies the transfer process and can provide peace of mind for both the property owner and their heirs. Understanding how this form works can help individuals make informed decisions about their estate planning.

Make Your Document Online

Fillable Transfer-on-Death Deed Document for North Dakota

Make Your Document Online

Make Your Document Online

or

➤ Transfer-on-Death Deed

Don’t walk away from an unfinished form

Finish Transfer-on-Death Deed online quickly from start to download.