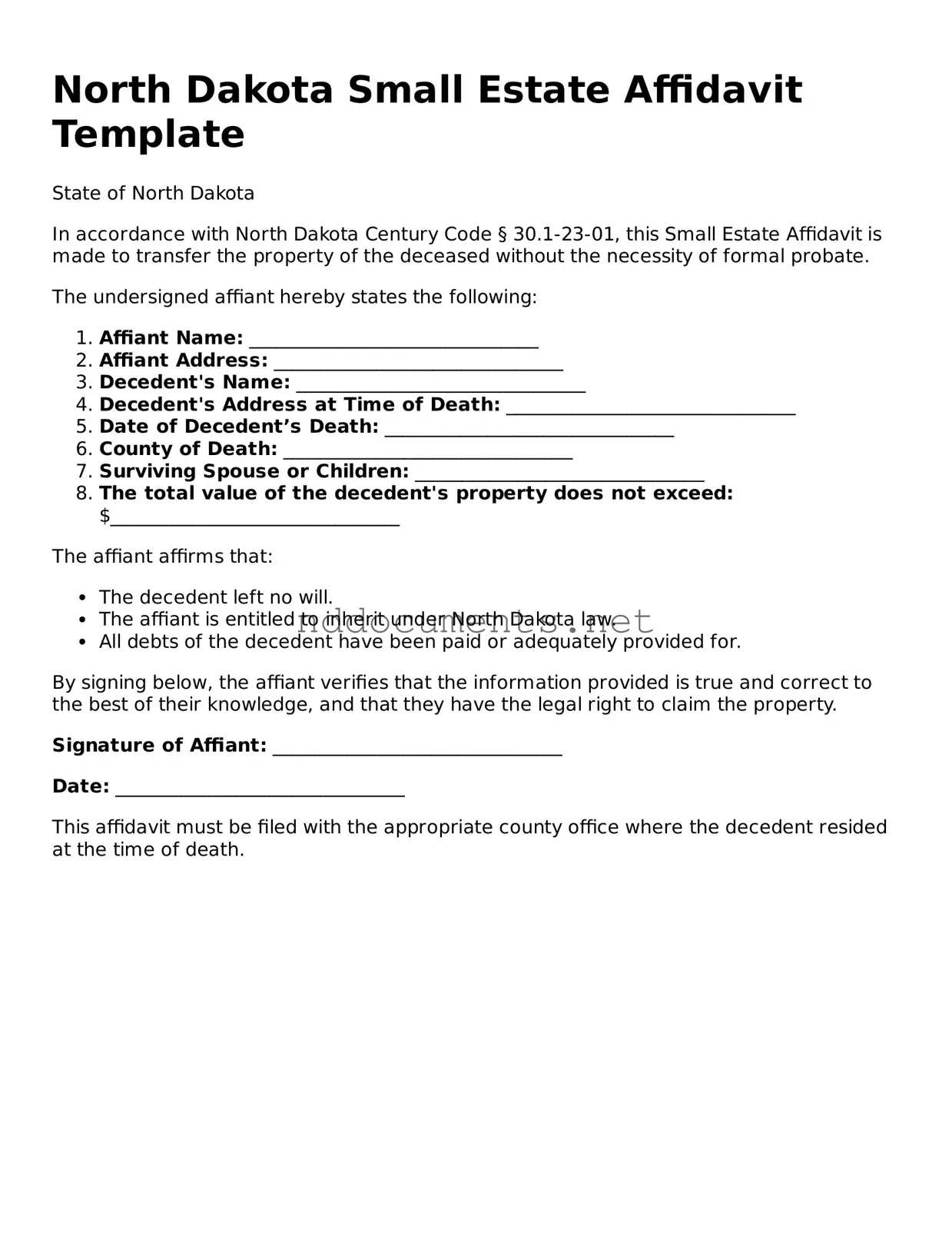

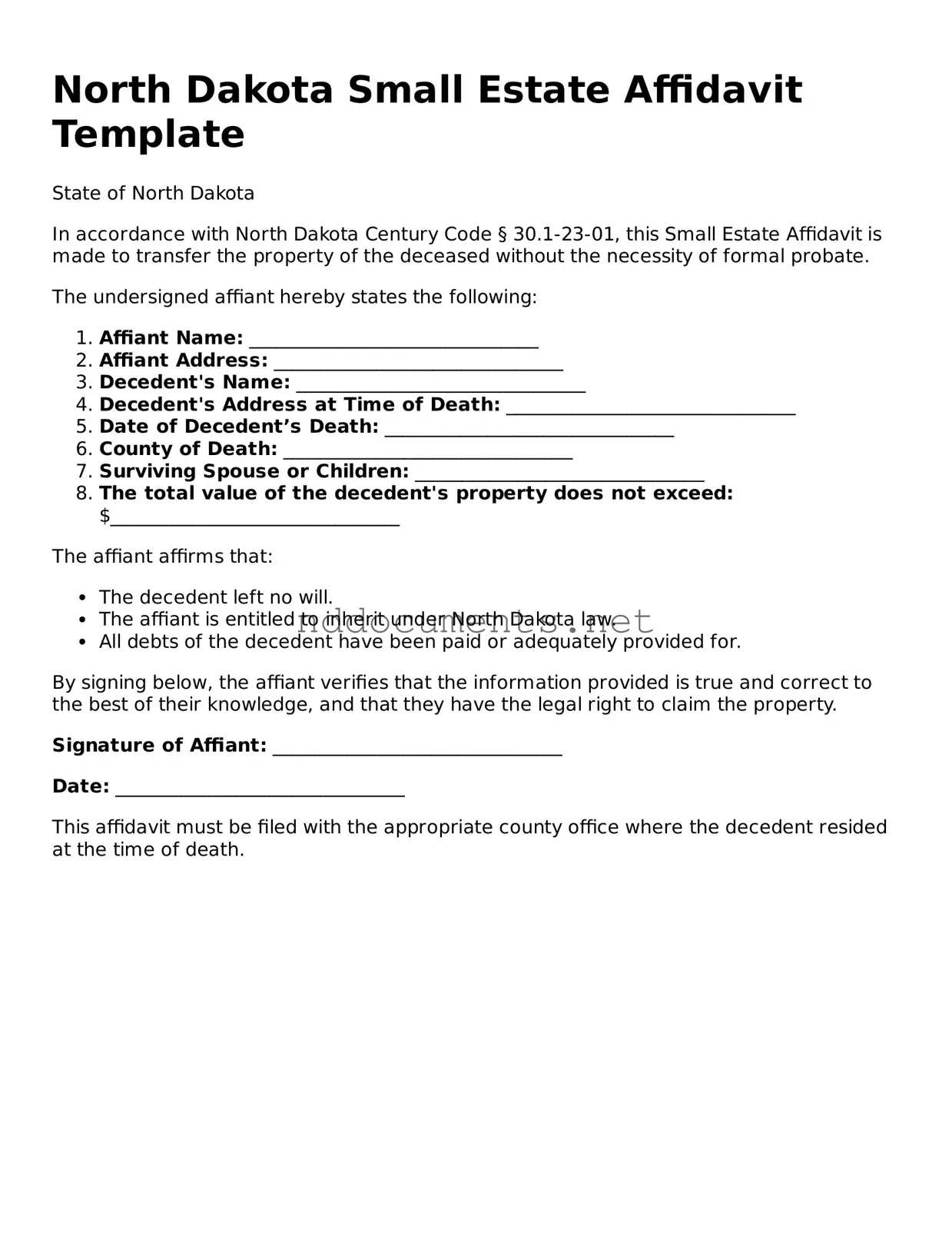

Fillable Small Estate Affidavit Document for North Dakota

The North Dakota Small Estate Affidavit form is a legal document that allows individuals to settle the estate of a deceased person without going through the formal probate process. This form is designed for estates that meet certain criteria, typically involving a limited value of assets. By using this affidavit, heirs can claim the deceased's assets more efficiently and with less expense.

Make Your Document Online

Fillable Small Estate Affidavit Document for North Dakota

Make Your Document Online

Make Your Document Online

or

➤ Small Estate Affidavit

Don’t walk away from an unfinished form

Finish Small Estate Affidavit online quickly from start to download.