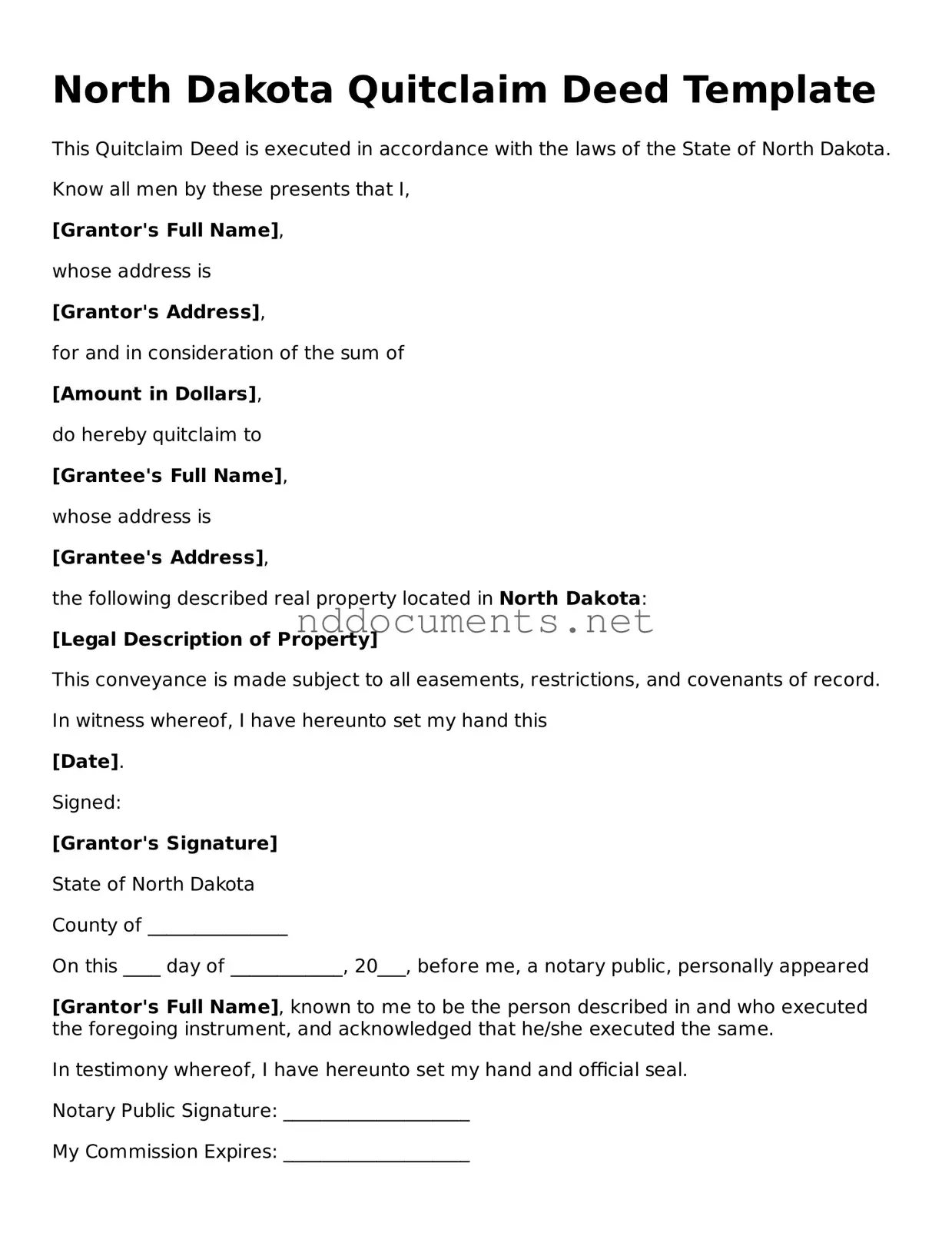

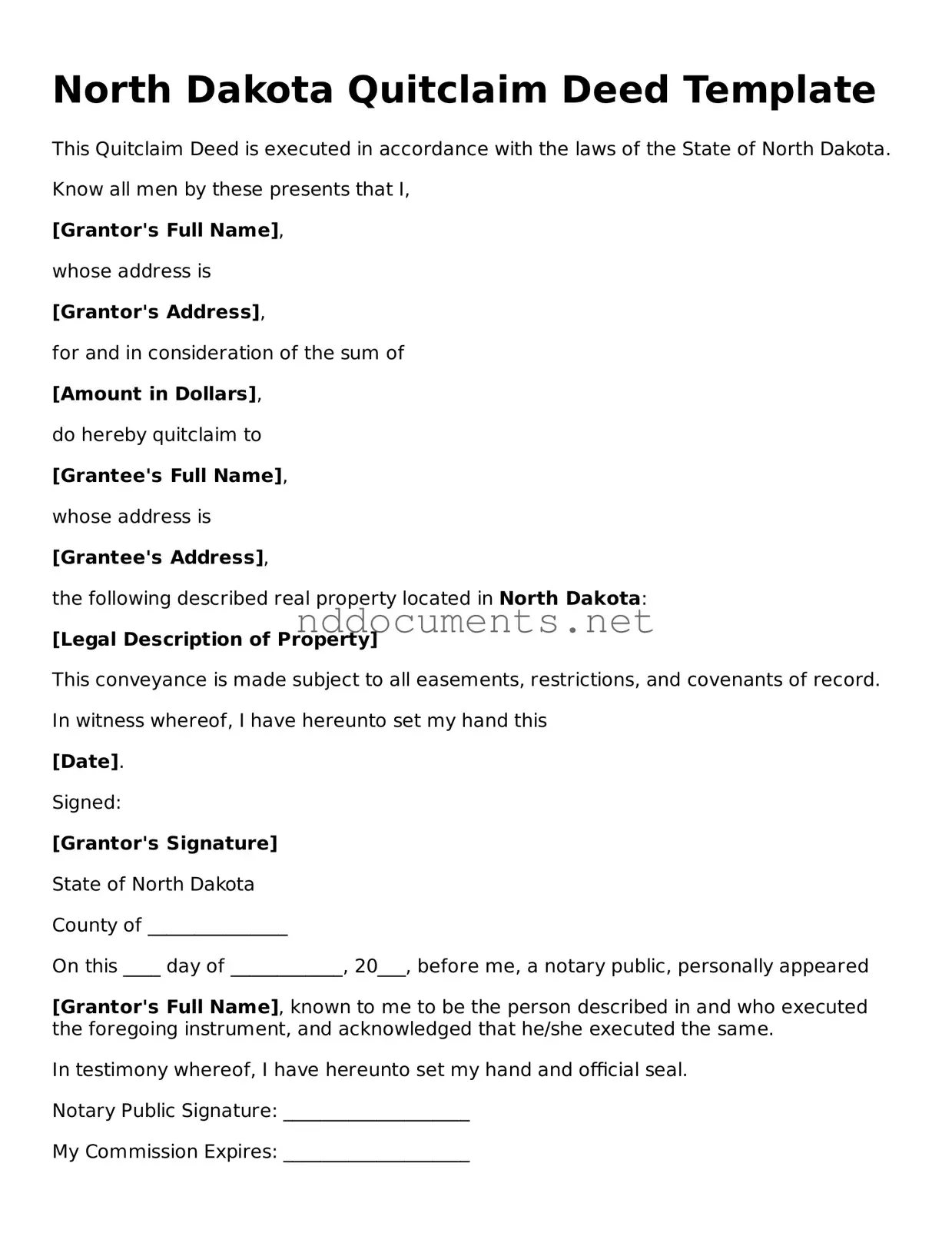

Fillable Quitclaim Deed Document for North Dakota

A North Dakota Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form is often used in situations where the seller is not providing any warranties about the property. Understanding how to properly complete and file this deed can simplify the property transfer process.

Make Your Document Online

Fillable Quitclaim Deed Document for North Dakota

Make Your Document Online

Make Your Document Online

or

➤ Quitclaim Deed

Don’t walk away from an unfinished form

Finish Quitclaim Deed online quickly from start to download.