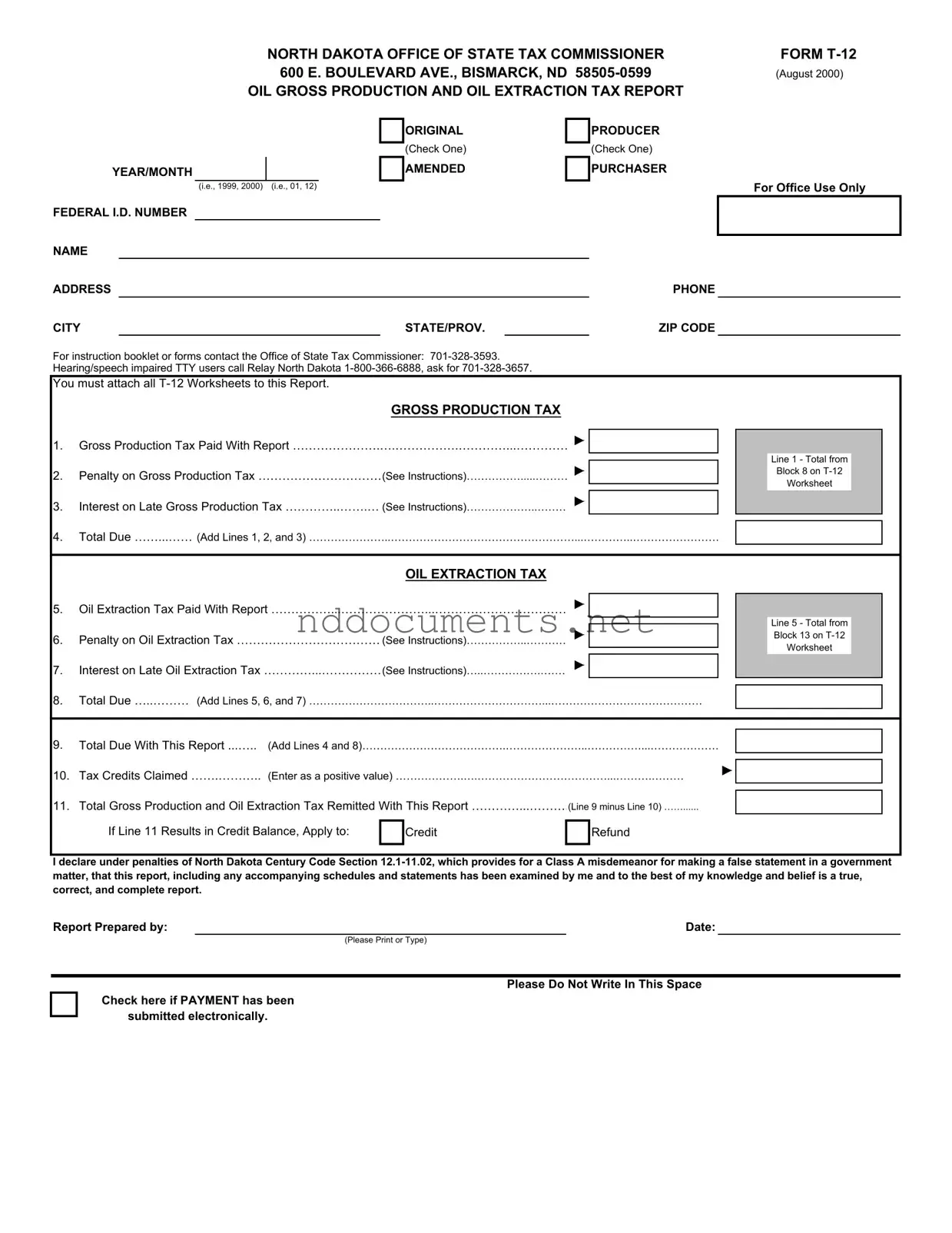

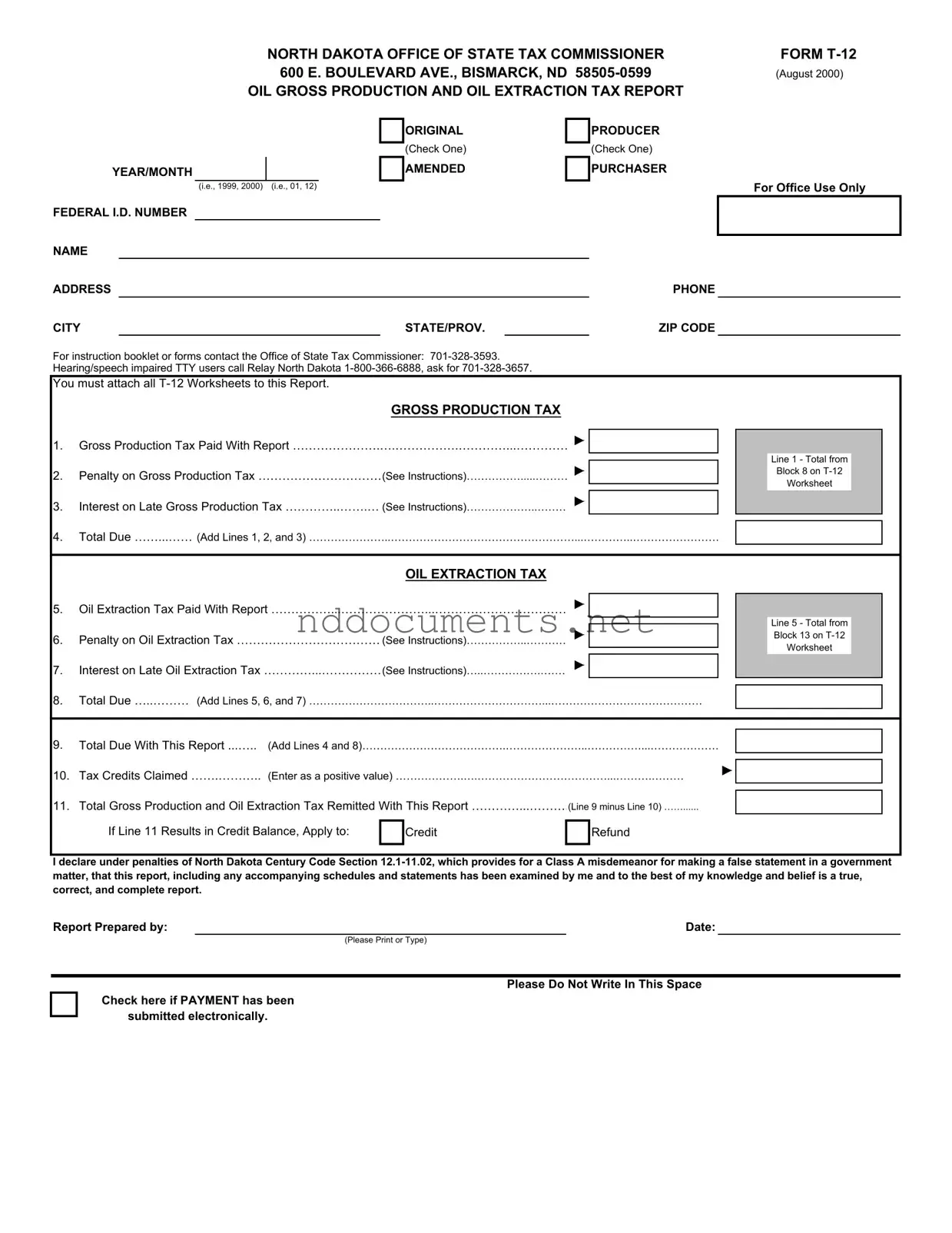

Free North Dakota T 12 Template

The North Dakota T 12 form is an essential document used for reporting oil gross production and oil extraction taxes in the state. This form must be completed by producers and purchasers, ensuring accurate tax reporting for each production period. Understanding how to fill out this form correctly is crucial for compliance and to avoid potential penalties.

Make Your Document Online

Free North Dakota T 12 Template

Make Your Document Online

Make Your Document Online

or

➤ North Dakota T 12

Don’t walk away from an unfinished form

Finish North Dakota T 12 online quickly from start to download.