Free North Dakota 58 Template

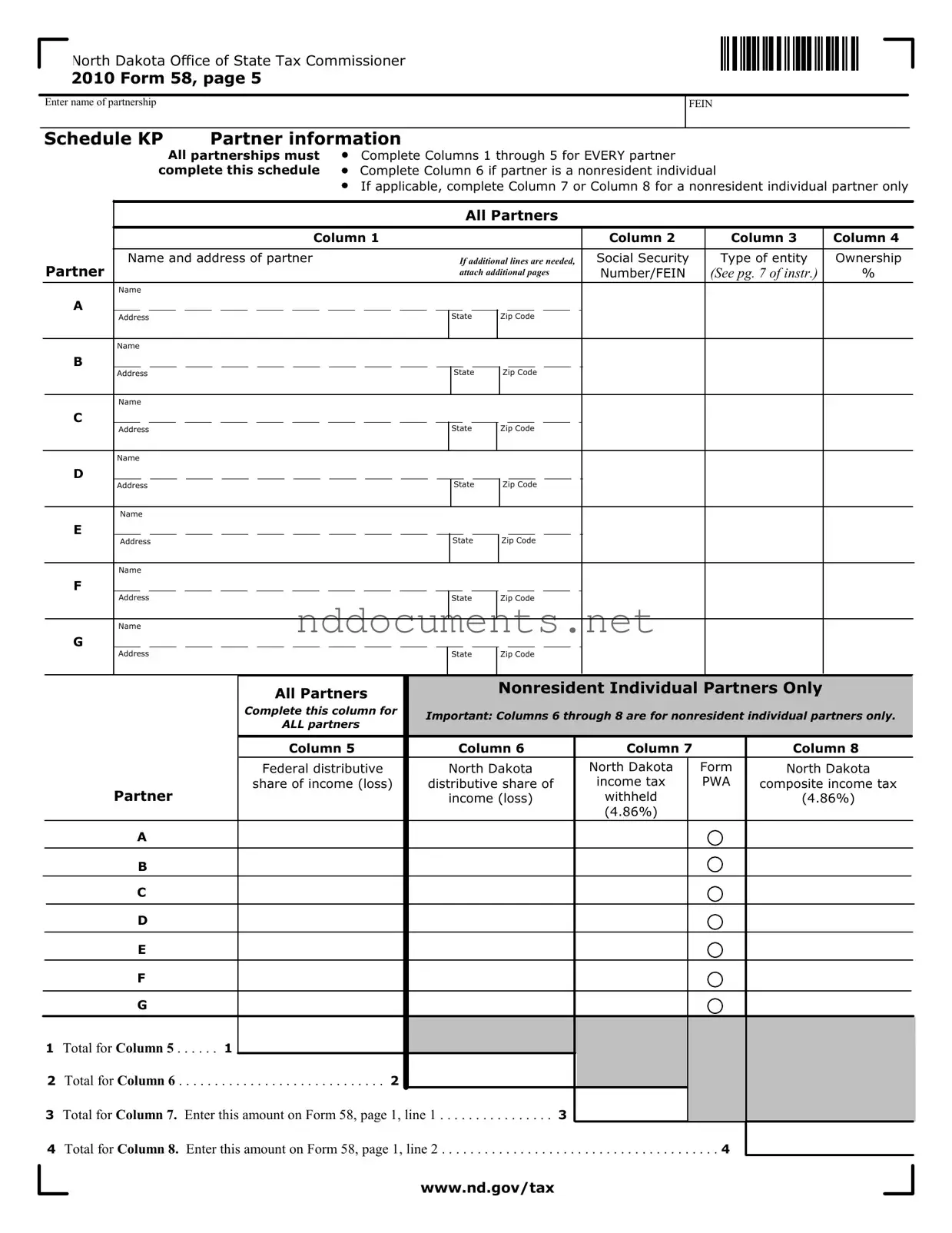

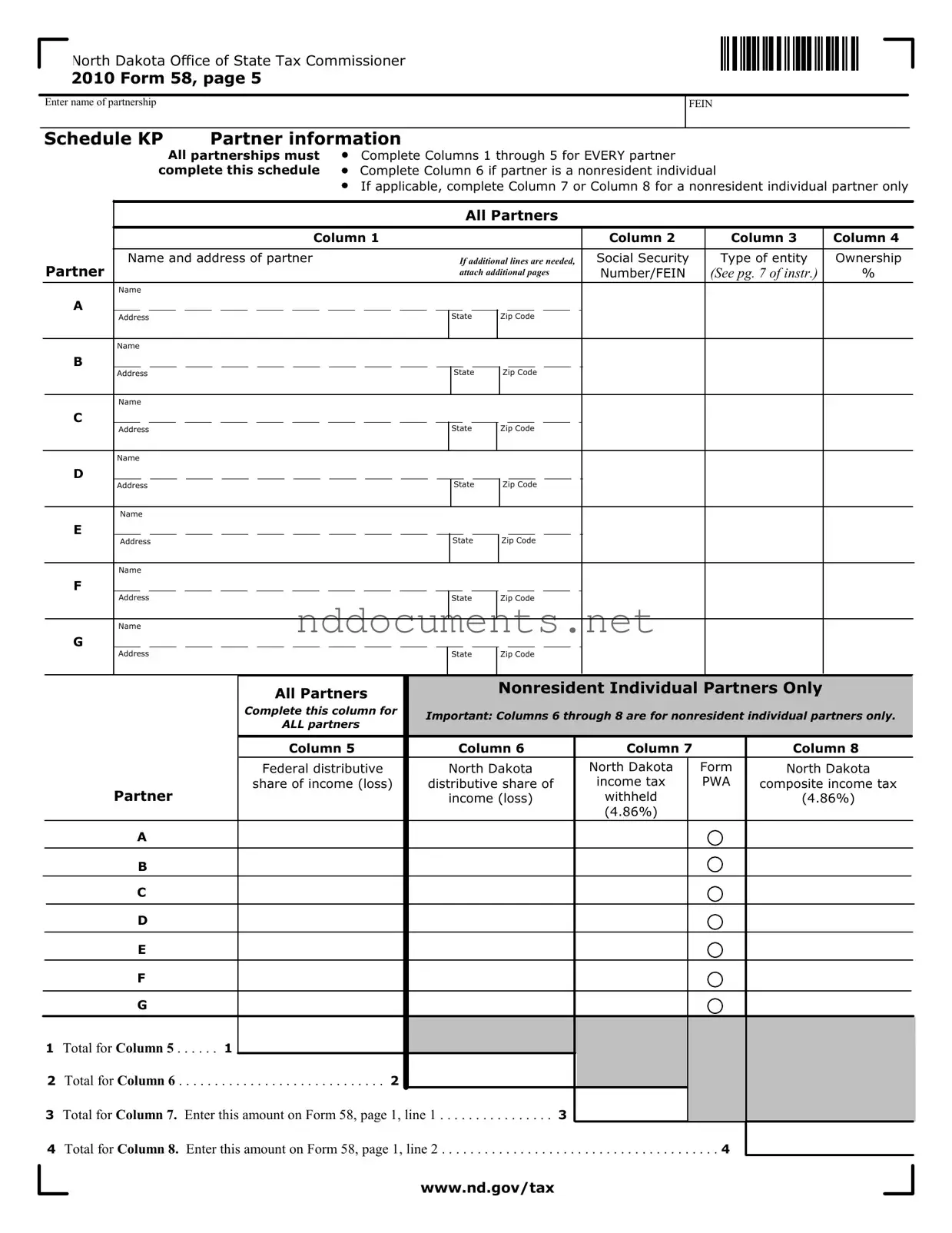

The North Dakota 58 form is a tax document used by partnerships to report income, losses, and partner information to the state. It requires detailed entries for each partner, including their name, address, and ownership percentage. Completing this form accurately is crucial for compliance with North Dakota tax regulations.

Make Your Document Online

Free North Dakota 58 Template

Make Your Document Online

Make Your Document Online

or

➤ North Dakota 58

Don’t walk away from an unfinished form

Finish North Dakota 58 online quickly from start to download.