Free North Dakota 38 Template

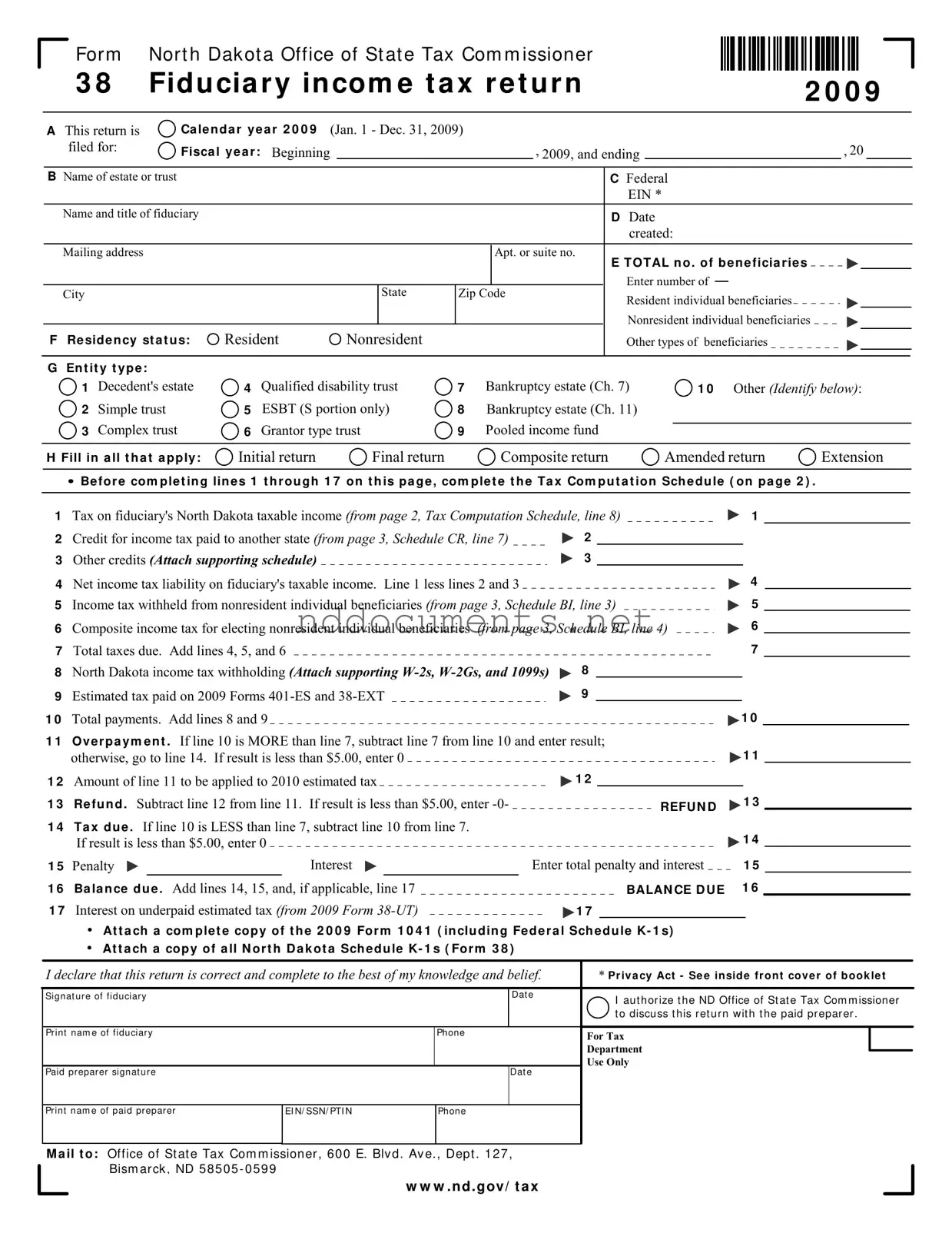

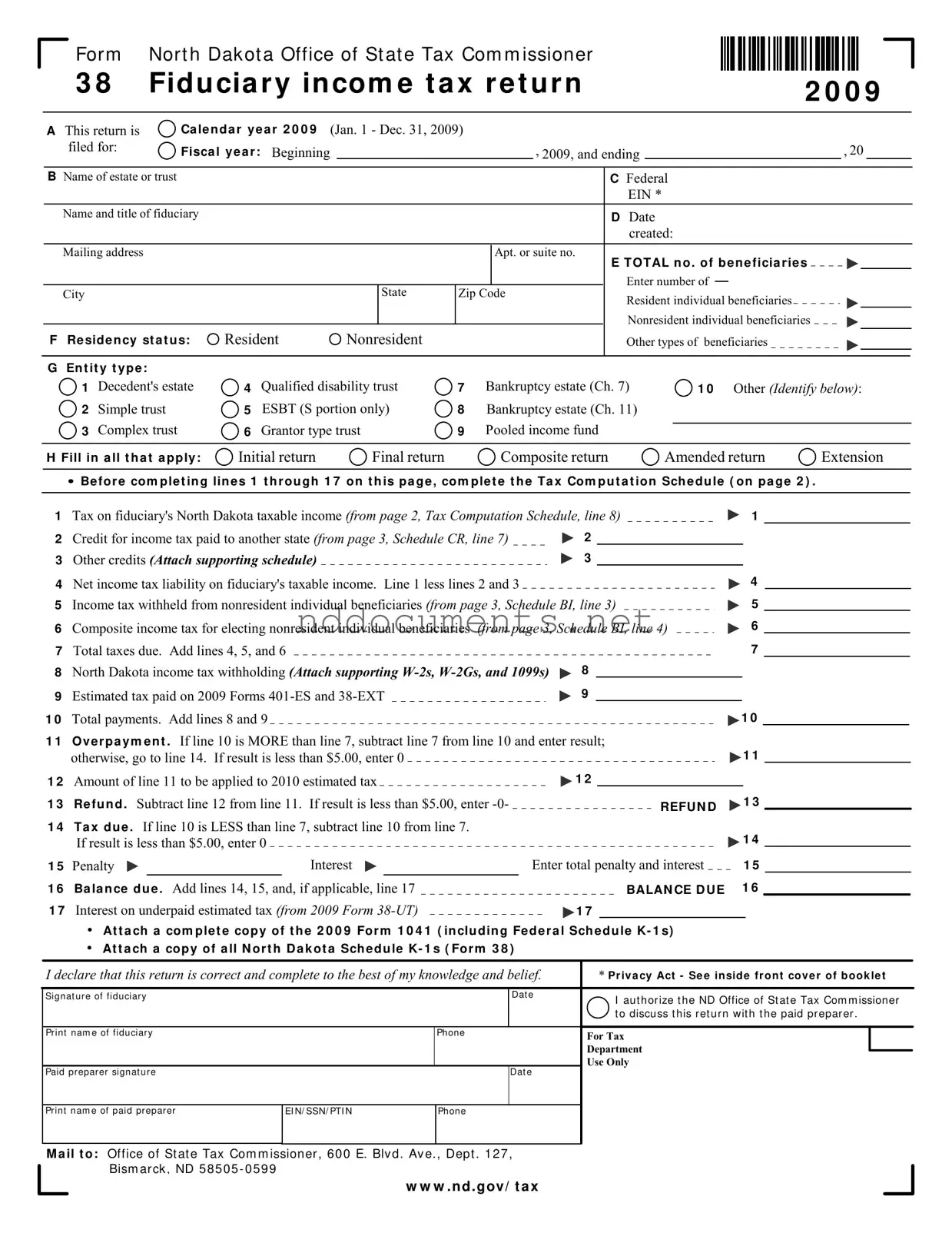

The North Dakota 38 form is a fiduciary income tax return used by estates and trusts in North Dakota. This form allows fiduciaries to report the income, deductions, and credits associated with the estate or trust for a specific tax year. Proper completion of this form is essential for compliance with state tax obligations and to ensure accurate tax calculations.

Make Your Document Online

Free North Dakota 38 Template

Make Your Document Online

Make Your Document Online

or

➤ North Dakota 38

Don’t walk away from an unfinished form

Finish North Dakota 38 online quickly from start to download.