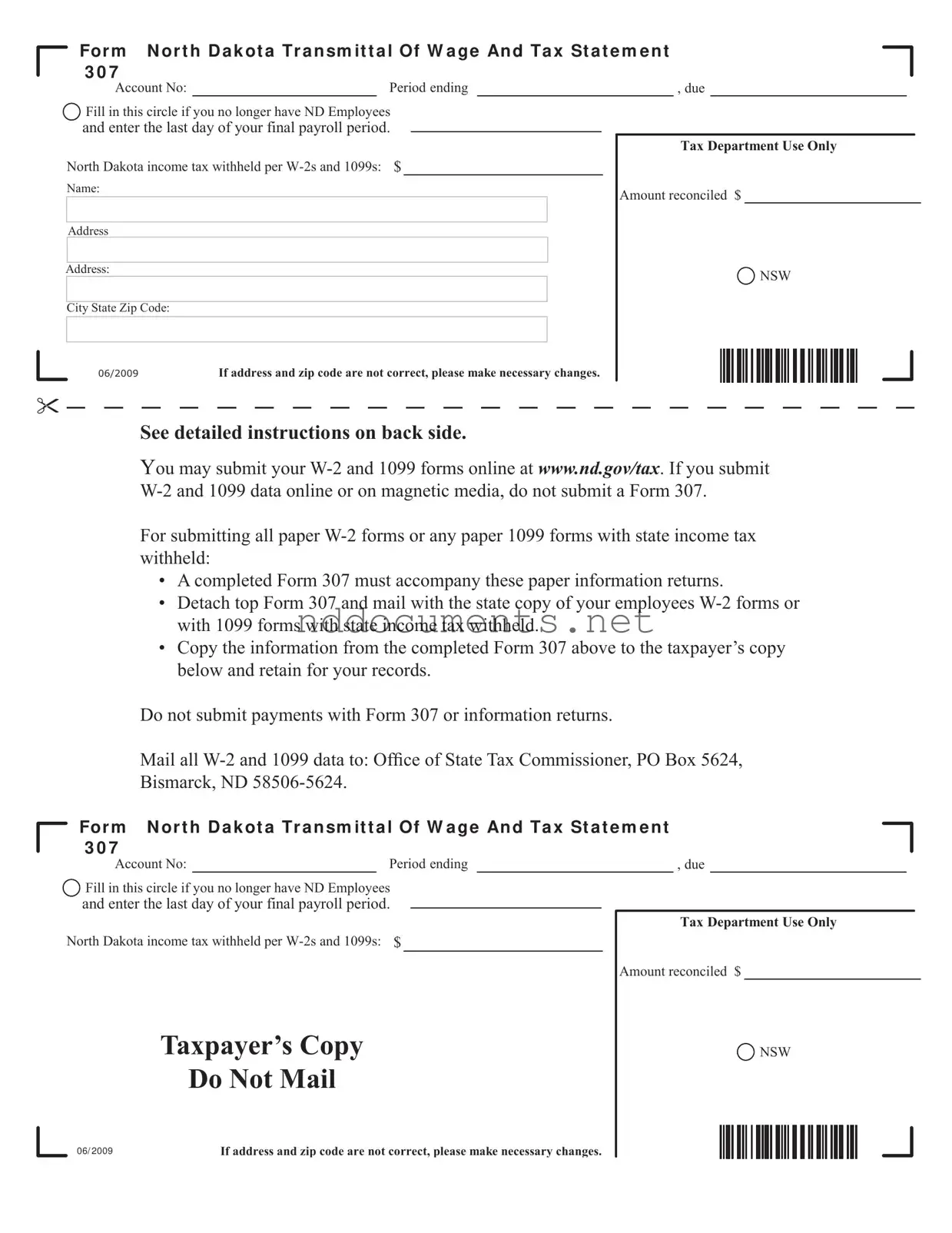

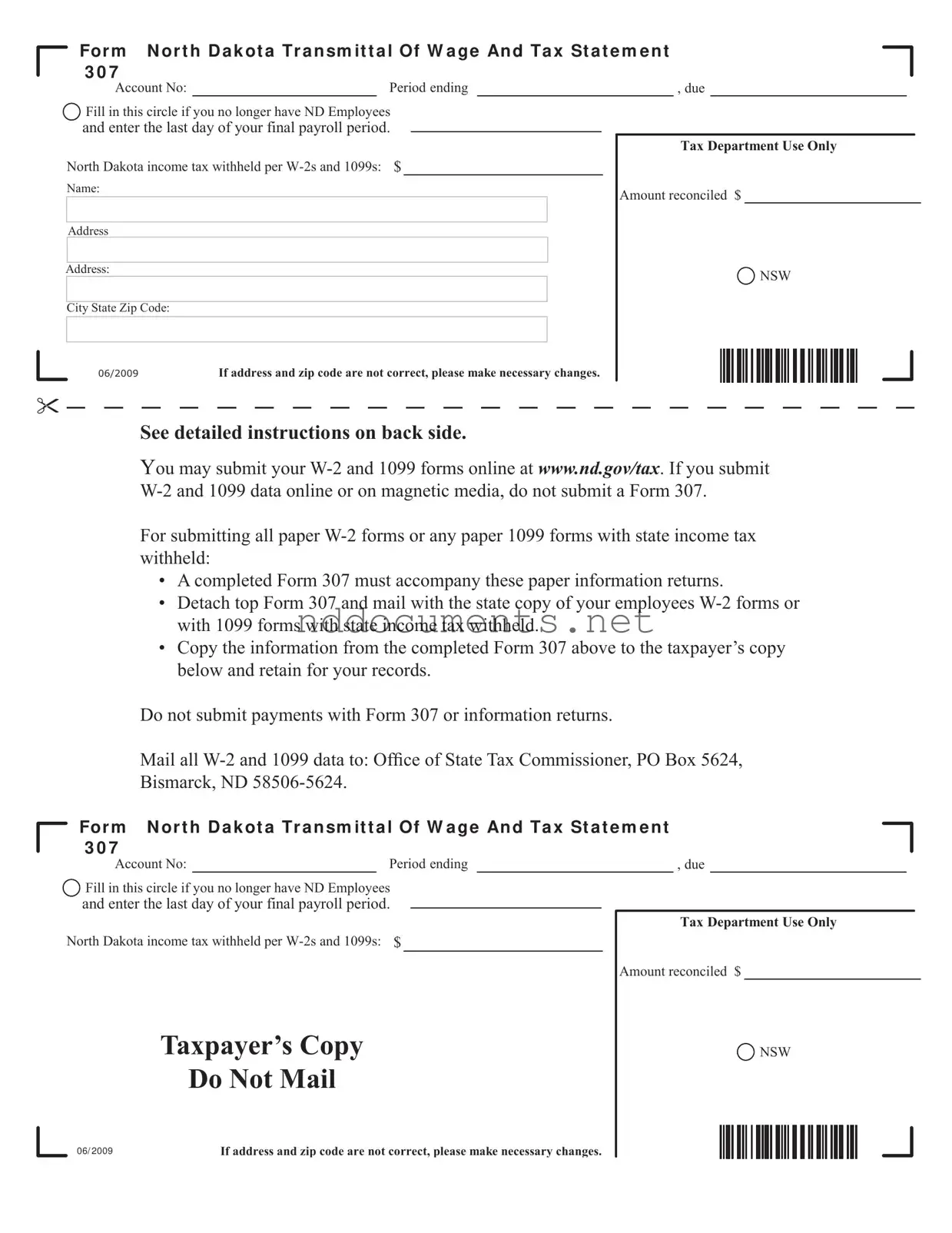

Free North Dakota 307 Template

The North Dakota 307 form is a wage and tax statement used by employers to report state income tax withheld from employee wages and payments. This form is essential for compliance with North Dakota's income tax withholding laws, whether or not the employer has withheld tax. Completing and submitting the 307 form ensures that all necessary tax information is accurately reported to the state tax authorities.

Make Your Document Online

Free North Dakota 307 Template

Make Your Document Online

Make Your Document Online

or

➤ North Dakota 307

Don’t walk away from an unfinished form

Finish North Dakota 307 online quickly from start to download.