Free F10 North Dakota Template

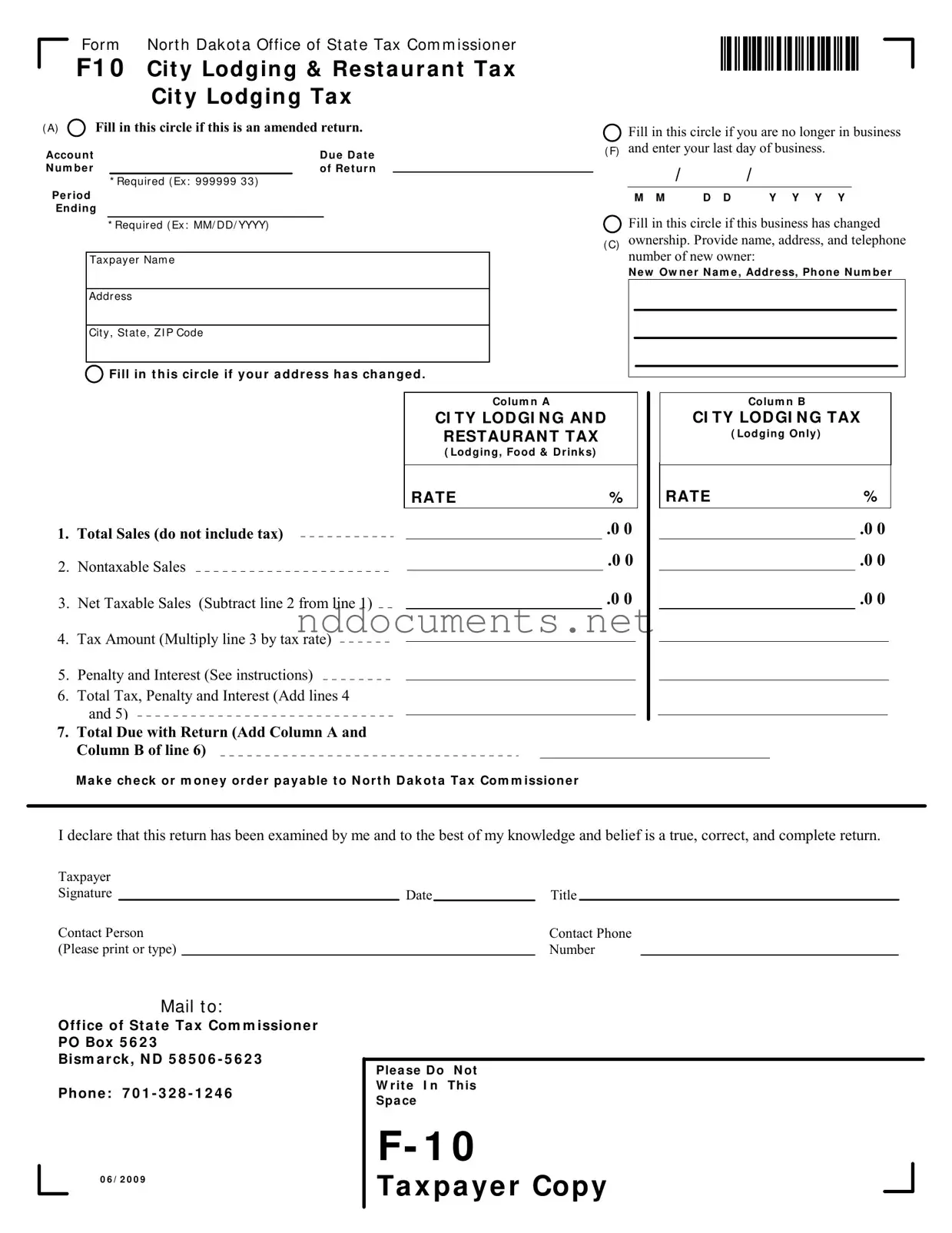

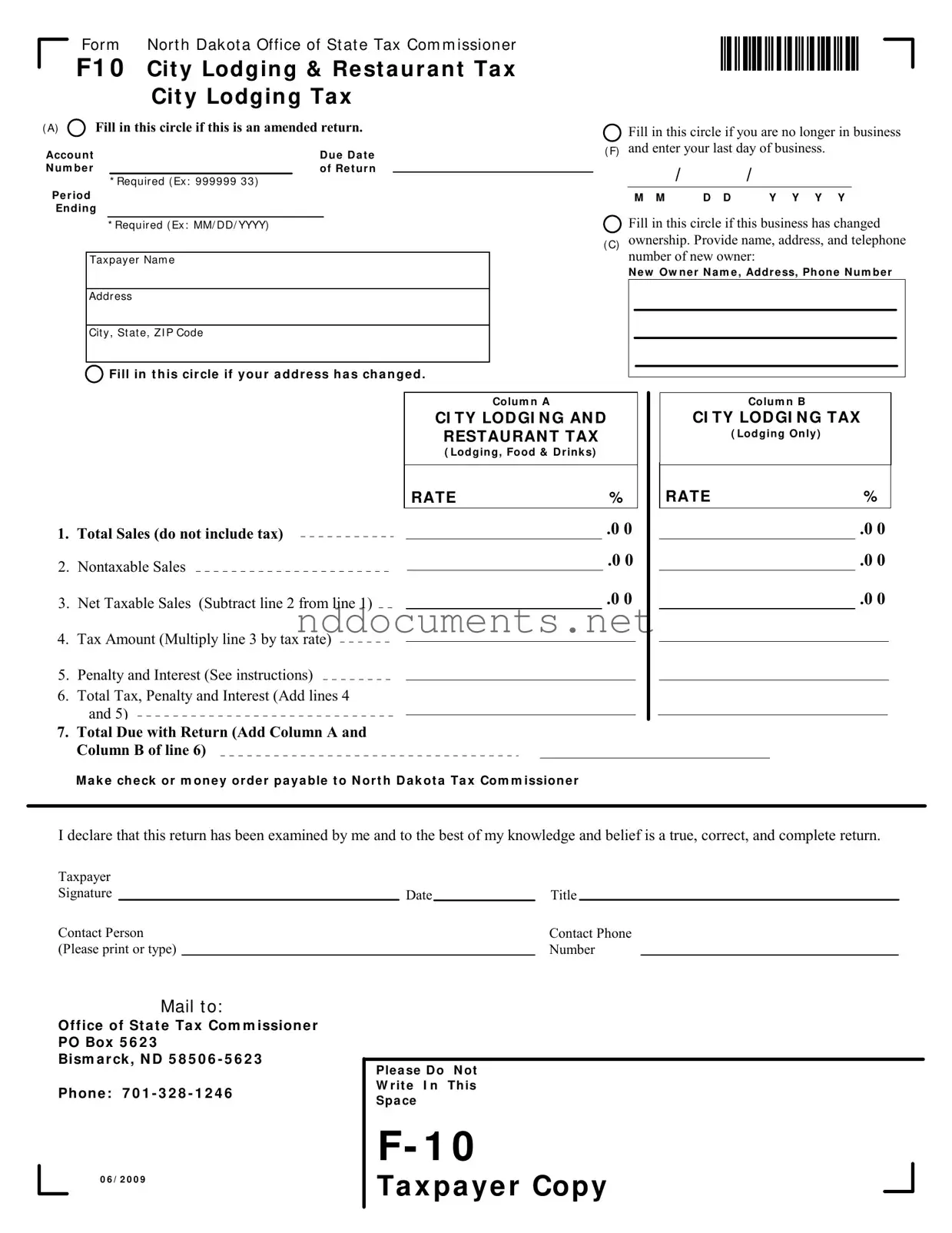

The F10 North Dakota form is used to report city lodging and restaurant taxes. This form is essential for businesses operating in North Dakota that provide lodging or food services. Completing it accurately ensures compliance with state tax regulations and helps avoid penalties.

Make Your Document Online

Free F10 North Dakota Template

Make Your Document Online

Make Your Document Online

or

➤ F10 North Dakota

Don’t walk away from an unfinished form

Finish F10 North Dakota online quickly from start to download.