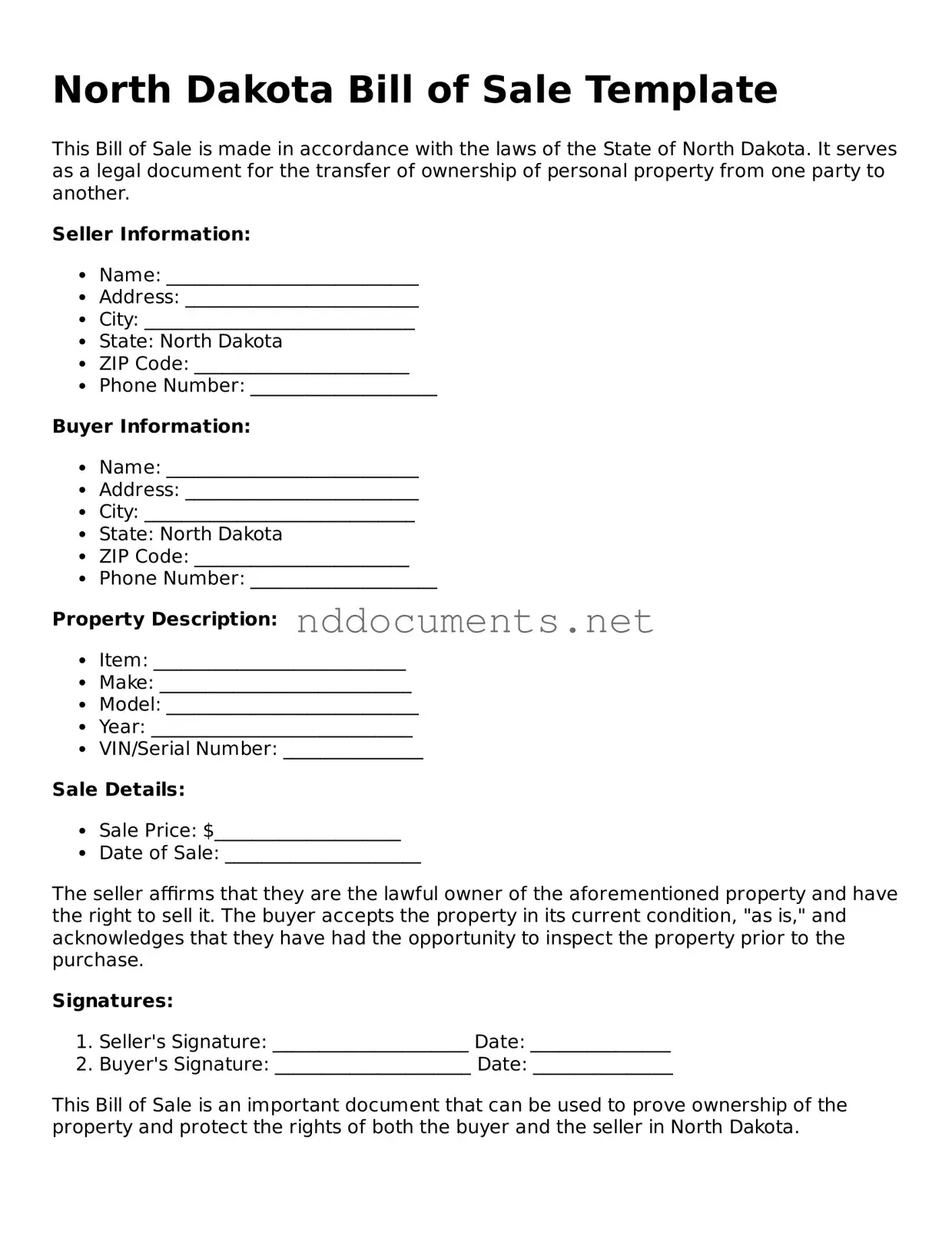

Fillable Bill of Sale Document for North Dakota

The North Dakota Bill of Sale is a legal document used to transfer ownership of personal property from one individual to another. This form provides essential details about the transaction, including the buyer, seller, and a description of the item being sold. Understanding its importance can help ensure a smooth transfer and protect both parties involved.

Make Your Document Online

Fillable Bill of Sale Document for North Dakota

Make Your Document Online

Make Your Document Online

or

➤ Bill of Sale

Don’t walk away from an unfinished form

Finish Bill of Sale online quickly from start to download.